|

|

|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Hubbell Stock Underperforming the Dow?/Hubbell%20Inc_%20office%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

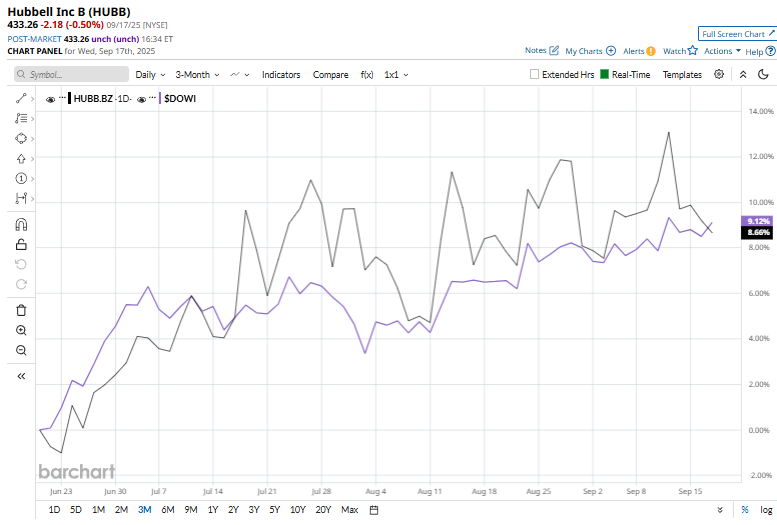

With a market cap of $23.1 billion, Hubbell Incorporated (HUBB) is a Shelton, Connecticut-based electrical and utility solutions manufacturer. Operating through two main segments, Utility Solutions and Electrical Solutions, the company serves industries from utilities and data centers to commercial and residential markets. Companies worth $10 billion or more are generally described as "large-cap stocks", and HUBB fits this description perfectly. Hubbell’s diversified portfolio, infrastructure exposure, and strategic acquisitions position it well for long-term growth. Hubbell currently trades 10% below its all-time high of $481.35 recorded on Nov. 6, 2024. HUBB's stock has surged 10.8% over the past three months, surpassing the broader Dow Jones Industrial Average’s ($DOWI) 9% rise during the same time frame.

In the long term, HUBB stock has surged 3.4% on a YTD basis, underperforming the $DOWI’s 8.2% increase. Moreover, shares of HUBB have gained 5.3% over the past 52 weeks, also underperforming $DOWI’s 10.6% returns over the same period. HUBB stock has been trading above its 50-day and 200-day moving averages since July, indicating an uptrend.

On Jul. 29, Hubbell released its second-quarter earnings, and its shares dipped 2.5% in the next trading session. Its organic sales benefited from strong demand in substation and transmission products as well as continued momentum in the data center market, driving growth across both segments. Still, overall net sales rose just 2.2% year-over-year to $1.5 billion, falling short of Wall Street expectations by 1.4%. On the earnings front, however, the company delivered stronger results, with adjusted EPS climbing 11% to $4.93, beating consensus estimates by a robust 13.1%. Its peer, Vertiv Holdings Co. (VRT), has performed better, with shares up 20.4% in 2025 and has surged 56.8% over the past 52 weeks. Among the 12 analysts covering the HUBB stock, the consensus rating is a “Moderate Buy.” Its mean price target of $465.67 suggests a 7.5% upside potential from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|